Ok so I know I’m a little late this month, I was putting my feet up and relaxing. While being eaten alive by mosquitos. Hopefully you’ve seen that the money is in. March was quiet-ish, last years winner qriffin spent a lot of the time in the number 1 spot, before dropping out of the top 10 and vanishing into the ether. Qriffin where are you, come back, jaDEB misses you!

Ok so I know I’m a little late this month, I was putting my feet up and relaxing. While being eaten alive by mosquitos. Hopefully you’ve seen that the money is in. March was quiet-ish, last years winner qriffin spent a lot of the time in the number 1 spot, before dropping out of the top 10 and vanishing into the ether. Qriffin where are you, come back, jaDEB misses you!

So since I don’t have much interesting news to give you, I’m going to cheat a little and write about someone else’s writing. I saw a finance post on facebook that had received a lot of likes and shares. The title is ‘The Ultimate Cheat Sheet For What You Should Do With All Of Your Money‘ and it’s written by someone called James Altucher who’s been a hedge fund manager, venture capitalist and best selling author and was posted on Business Insider. Great title, but let’s take a look at the content.

In 2001 and 2002 I lost all my money through bad investing. The same thing happened to me on a couple of occasions after that.

Well ok then, maybe he’s learnt something, and can help us avoid some of his mistakes. He also says a little later on that we shouldn’t listen to him. Interesting guy!

SHOULD I DAYTRADE?

Only if you are also willing to take all of your money, rip it into tiny pieces, make cupcakes with one piece of money inside each cupcake and then eat all of the cupcakes.

Yep, I’d have to agree here.

WELL, WHO MAKES MONEY IN THE MARKET THEN?

Three types of people:

1) People who hold stocks FOREVER. Think: Warren Buffett (has never sold a share of Berkshire Hathaway since 1967) or Bill Gates (he sells shares but for 20 years basically held onto his MSFT stock).

2) People who hold stocks for a millionth of a second (see Michael Lewis’s book “Flash Boys” which I highly recommend.) This is borderline illegal and I don’t recommend it.

3) People who cheat.

I quite like James, wish he wasn’t right on number 3, but I have a feeling he is.

What stocks should I hold?

Warren Buffett has some advice on this (and I know because I wrote THE book about him. A friend of mine who knows him told me my book was the only book that Buffett thought was accurate about him). He says, ‘if you think a company will be around 20 years from now then it is probably a good buy right now.’ I would add to that, based on what Warren does. It seems to me he has five criteria:

a. A company will be around 20 years from now.

b. At some point, company’s management has demonstrated in some way that they are honest, good people. If you can get to know management even better.

c. The company’s stock has crashed for some reason (think American Express in early 60s, which he loaded up on. Or Washington Post in the early 70s. Or Coca-Cola in the early 80s).

d. The company’s name is a strong brand: American Express, Coke, Disney, etc.

e. Demographics play a strong role.

I’m a huge fan of Buffett. I like the way he thinks about finance, and how he speaks about it. I also quite like that this piece of advice isn’t too heavy on finance. It sounds quite reasonable to me too, but since I don’t have my days free to look this stuff up, I’ll just keep buying my ETFs.

SHOULD I PUT ALL OF MY MONEY IN STOCKS?

No more than 30% of your portfolio in stocks (unless some of the stocks grow, in which case you just keep letting them grow).

Umm what was that? As I’ve written before, stocks have proven repeatedly to beat every other investment sector given enough time. Why on earth would you only want 30% of your money making as much as possible. Are you scared you won’t be able to carry your wallet around one day?

WHAT ABOUT MUTUAL FUNDS?

No. Mutual funds, and the bank representatives that push them, consistently lie about the fees they are charging. I know this from experience. Fact: Mutual funds don’t outperform the general market so better to invest in the general market without paying the extra layer of fees.

Phew, good to have the smart James back with us, I was a little worried about you there dude. Mutual funds, unit trusts and retirement annuities are just ways of giving a portion of your investments to somebody who already has way more money than you.

IS A HOUSE A GOOD INVESTMENT?

Everyone will disagree with me on this but the answer is an emphatic NO!

Not quite, I actually do agree with you here James. James mentions taxes, maintenance, debt etc. but that are even more reason why it’s a bad investment. Even if you paid cash, it would mean your money is tied up and not working for you.

I’m not saying don’t buy a house, but don’t buy it because you think it’s an investment. If you’ve read rich dad poor dad you’d know that something that costs you money is a liability, not an investment, your house is a lifestyle choice that costs you money, nothing more. A second property could be considered an investment though, in some cases a good one, but it’s not low risk by any means.

Firstly you must have heard the horror stories about how hard it is to get rid of a bad tenant in South Africa, and then secondly, your investment is tied physically the the fortunes of not only the country, but that city and neighbourhood. If you bought in the hip and happening Hillbrow in the 70’s and never sold. Do you think you’d be doing well today? By contrast, if you’d put a similar amount of money on a well diversified stock portfolio in the 70’s you’d likely be living the good life today.

IF NO HOUSING AND ONLY 30% OF MY PORTFOLIO IN STOCKS, THEN WHAT SHOULD I DO WITH THE REST OF MY MONEY?

Why are you in such a rush to put all of your money to work? Relax! Don’t do it! There’s a saying ‘cash is king’ for a reason… Cash is a beautiful thing to have. You can pay for all of your basic needs with it. You can sleep at night knowing there is cash in the bank.

Sigh, James, James, James… What do you think is happening while you sleep happily at night. Your cash is running away from you. One of the local banks has a funny commercial about money babies! They’re wrong of course, since the money babies (interest) are born at a far lower rate than the money funerals (inflation). It’s a guaranteed loss. The only reason I could think of having cash in my bank, aside from an small emergency fund, is because I’m psychic and I can see when the crash coming. If you’d like to know when the crash is coming, please send a cash cheque for R20 000 to PO Box …

SHOULD I SAVE MONEY WITH EACH PAYCHECK?

No. Just try to make more money. That is easier than saving money. I find that whenever I try to save money I end up spending more. I don’t know why that is. I’m a horrible spender, which is probably why I’ve gone broke so many times.

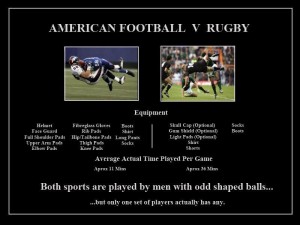

James, what are you doing here. You’ve hit rock bottom and now you’re looking for a better drill. Money can be a bit like a game of rugby. I know you’re American so you have no clue what rugby is, for your benefit it’s like American football without the ballet leotards and pansy tea breaks every 30 seconds. Anyway, back to money and rugby. To become wealthy you need to have both good financial offense and good financial defense. It’s no good making an absolute fortune if you can’t hang on to any of it. Think Mike Tyson. It’s also no good to save 50% of your salary if you are unemployed. Well rounded James, and I’m not talking about your figure here.

The rest of the article was an interesting mix of the esoteric, mundane and insane, a very good read though. While I doubt I’d follow a huge amount of James’ advice, I would love to have him over for a braai. I’m sure he’s a great guy, and there would definitely be some good stories on offer. The full article can be found here if you’d like to give it a read: http://www.businessinsider.com/money-cheat-sheet-2014-4

As usual, comments in the forum please: http://www.shareforum.co.za/the-investor-challenge/blog-post-what-financial-cheat-sheet-is-this/

Go forth and profit,

Patrick